2024 Tax Rates

|

The mill rate for 2024 remains unchanged at 11.0.

This includes a Mill Rate Factor of 0.6 for Residential Properties. 2024 Tax Notices were mailed out on Monday, July 22. If you do not receive your tax notice within 1-2 weeks, please call the office for a copy. |

The education property tax mill rates to be levied with respect to every school division and property class for the 2024 taxation year are as follows:

|

Notice of Assessment Roll - Closed

Notice is hereby given that the assessment roll for the R.M. of Arborfield No. 456 for the year 2024 has been prepared and is open to inspection in the office of the assessor during business hours from April 3, 2024 to May 6, 2024.

You will only receive an assessment notice if there was a change of ownership or a change of assessment value. A change of assessment value would have occurred from either a maintenance change (changes to dwelling or a new subdivided parcel) or an assessment exemption change.

A bylaw pursuant to Section 214 of The Municipalities Act has been passed and the assessment notices have been mailed as required.

Any person wishing to discuss the notice of assessment or potential appeal may contact the assessor at the R.M. of Arborfield Office.

A notice of appeal, accompanied with the $50.00 appeal fee (which will be returned if the appeal is successful) must be filed with the Secretary of the Board of Revision, Mike Ligtermoet, Nor-Sask Board Services, 642 Agnew St., Prince Albert, SK S6V 2P1 by the 6th day of May, 2024.

Dated this 2nd day of April, 2024.

Andrea Bell, Assessor.

You will only receive an assessment notice if there was a change of ownership or a change of assessment value. A change of assessment value would have occurred from either a maintenance change (changes to dwelling or a new subdivided parcel) or an assessment exemption change.

A bylaw pursuant to Section 214 of The Municipalities Act has been passed and the assessment notices have been mailed as required.

Any person wishing to discuss the notice of assessment or potential appeal may contact the assessor at the R.M. of Arborfield Office.

A notice of appeal, accompanied with the $50.00 appeal fee (which will be returned if the appeal is successful) must be filed with the Secretary of the Board of Revision, Mike Ligtermoet, Nor-Sask Board Services, 642 Agnew St., Prince Albert, SK S6V 2P1 by the 6th day of May, 2024.

Dated this 2nd day of April, 2024.

Andrea Bell, Assessor.

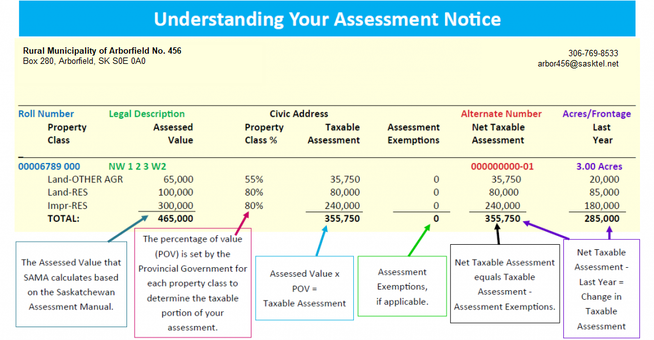

Municipal Assessment and Taxation

Property assessment is the process of determining a property's assessed value for tax purposes. The assessed value is not the market value; however, the assessed value will closely resemble a current market value for most properties. All properties are reassessed every four years, the latest one done in 2021. If there have been no changes to your property since the reassessed value change in 2021, there will be no changes until 2025.

The RM of Arborfield uses the Saskatchewan Assessment Management Agency (SAMA) to calculate and update all assessments within the municipality. SAMA performs annual maintenance updates to properties showing an increase or decrease in assessment.

The RM of Arborfield uses the Saskatchewan Assessment Management Agency (SAMA) to calculate and update all assessments within the municipality. SAMA performs annual maintenance updates to properties showing an increase or decrease in assessment.

|

SAMAView is an online search tool that allows general public access to property assessment information in municipalities, where assessment services are provided by SAMA. Using your Assessment ID number shown on your notice, you can search for your property.

Should you wish to discuss your properties valuation, please contact SAMA directly and they will review your property profile with you. The phone number for the SAMA office is 306-752-6142. |

Understanding Your Assessment Notice

Assessment Appeals

If you feel your assessment is in error you can appeal it if you have sufficient grounds for the appeal. For example, perhaps SAMA has rated the condition of your property 'average', but you feel it is in 'poor' condition, or they have assessed a deck on your property in 2002 and the deck has since been removed.

The more information you can provide to back up your grounds for appeal the better.

Any person with an interest in the assessed value or the classification of property can appeal the property assessment.

You can appeal if you believe there has been an error in:

The more information you can provide to back up your grounds for appeal the better.

Any person with an interest in the assessed value or the classification of property can appeal the property assessment.

You can appeal if you believe there has been an error in:

- the assessed value;

- the classification;

- the contents of the assessment roll; and

- the assessment notice.

293 Exemption

|

Section 293 of The Municipalities Act allows for a tax adjustment to dwellings within the Rural Municipality outside of organized hamlets. The taxable assessment of the dwelling may be reduced by the taxable assessment of any land in this or in an adjoining municipality that is owned or leased by the occupant.

To have this exemption applied to your dwelling, you must complete and return this form to the municipal office by March 31st each year. |

Further information regarding Property Assessment and Taxation can be found on the Government of Saskatchewan website.